Festive seasons are a golden ticket for businesses to hit their expected annual turnover with high profit margins. Out of all the festivals, the ones that come at the year's end—Thanksgiving, Christmas, and New Year for many countries, and Diwali, Christmas, and New Year for India—bring a business boom but also bring chaos. All the increased footfall, temporary staff, longer work hours, and crowded environment open gates for errors, theft, and fraud.

To stay profitable and avoid being robbed of your profits, implementing a few preventive and security measures will act as a backbone for your busy festive-season business. Let's check all the possible thefts and frauds that could happen in your store and what preventive measures you can take as a smart proprietor.

Understanding the threat landscape

What is ORC (organized retail crime)?

Organized retail crime (ORC) is one of the major threats you should look out for. These are individuals or people working in a group that target retail stores during busy hours. They distract the staff, take advantage of security loopholes, and steal goods in bulk. These groups are also experts in refund fraud. Either of these activities affect a business' capital which, in turn, leads to inventory shrinkage and financial loss.

Types of theft you should watch out for

- Customer theft: Shoplifting, tag switching, or taking advantage of crowded stores to walk out with unpaid items or even steal cash out of registers.

- Employee theft: Unbilled sales, pilferage from stockrooms, cash theft from cash registers, unauthorized discounts, or misuse of data access.

Strengthen your store security infrastructure

Surveillance & monitoring systems

A strong visual environment is the first line of defense.

- Install CCTV cameras covering billing counters, warehouse/inventory areas, and exits.

- Double-check parking lot security, as many thefts and attacks occur before or after checkout.

- Have someone monitor CCTV feeds in real time or get equipped with AI-based alerts for suspicious movements.

Access control measures

Not everyone needs to go everywhere.

- Use keycards or biometric access to restrict entry to the purchase department, storage rooms, cash offices, and server areas.

- Implement intrusion alarm systems that trigger alerts for unauthorized access and burglary break-ins after business hours.

Smart tagging & tracking

Technology helps keep track of assets automatically.

- Attach RFID tags to high-value items like electronics, appliances, and premium goods.

- Implement EAS (electronic article surveillance) gates to alert staff when unpaid items pass through exits.

Build a culture of awareness and accountability

Employee training

Your employees are your store's border patrol.

- Train them to recognize suspicious behavior like nervous customers, repeated visits, or attempts to distract staff.

- Equip them to handle difficult situations professionally without confrontation that might bring down the brand's reputation among other customers.

- Have a separate store manager and encourage timely reporting of any incident or irregularity to them.

Clear roles & responsibilities

Clarity prevents manipulation by individuals.

- Segregate duties between billing, cash management, and reporting to handle all operations seamlessly.

- Don’t let the cashier be the accountant. This gives the individual a lot of room to commit planned financial fraud.

- Ensure voided bills, refunds, or discounts require supervisor approval.

- Conduct periodic internal audits to keep teams accountable.

Use technology to detect & prevent fraud

Monitor and analyze POS activities

A good point-of-sale system can be a powerful fraud detector if used right.

- Track unusual transactions like frequent bill voids, unauthorized discounts, or abnormal refund patterns.

- Set up an OTP-based loyalty redemption system and set passwords for staff to edit or cancel a bill.

- Review shift-wise billing reports and compare sales versus stock depletion.

- Use dashboards to spot outlet-level anomalies instantly and get instant alerts for malpractice.

Secure digital transactions

During the festive season there would definitely be a surge in orders from online platforms and mobile payments, where frauds can happen beyond the counter.

- Post-festival season tends to receive a lot of return requests, so review the return and refund policies to avoid misuse of it by any fraudsters.

- Use secure online gateways and encrypted data transfer.

- Reconcile daily online payments to detect any discrepancies early.

Use AI and ML for fraud detection

Modern security systems use AI and machine learning to study suspicious patterns.

- They automatically flag outliers such as high-value voids, repetitive refunds, or suspicious discounts.

- Modern CCTV and store cameras are equipped with built-in AI and ML scripts that analyze and identify patterns of customers whose actions are suspicious; this helps you tag and monitor a potential threat well in advance.

Eliminate billing errors before they cost you

During peak hours and long waiting queues, billing speed often takes priority, and that’s when errors pop up. Use a software-based automated invoicing system that standardizes bill formats and prevents duplicate entries. Implement a POS system that integrates with your inventory, accounts, and counter billing to auto-update stock and ledgers with every sale. Try to have a staff member near the exit gate who can manually check the items purchased against the bill in their hand. Although this is a manual process, this helps identify and flag theft of items from the store. At the end of each day, cross-check daily sales and cash reconciliation using centralized reports to keep track of cash collected.

Manage customer flow smartly during peak hours

A chaotic store floor crowded with customers leads to distracted staff and unintentional errors. Predefine separate queues for billing: separate counters for carts with less than 10 products and separate ones for bulk purchases. Equip your staff with mobile POS devices that help them bill customers at their convenience without relying on the limited hardware available, reducing crowding at counters. Plan the cashier sessions effectively and schedule breaks strategically so you always have experienced staff available during high rush periods to handle the busy customer movement.

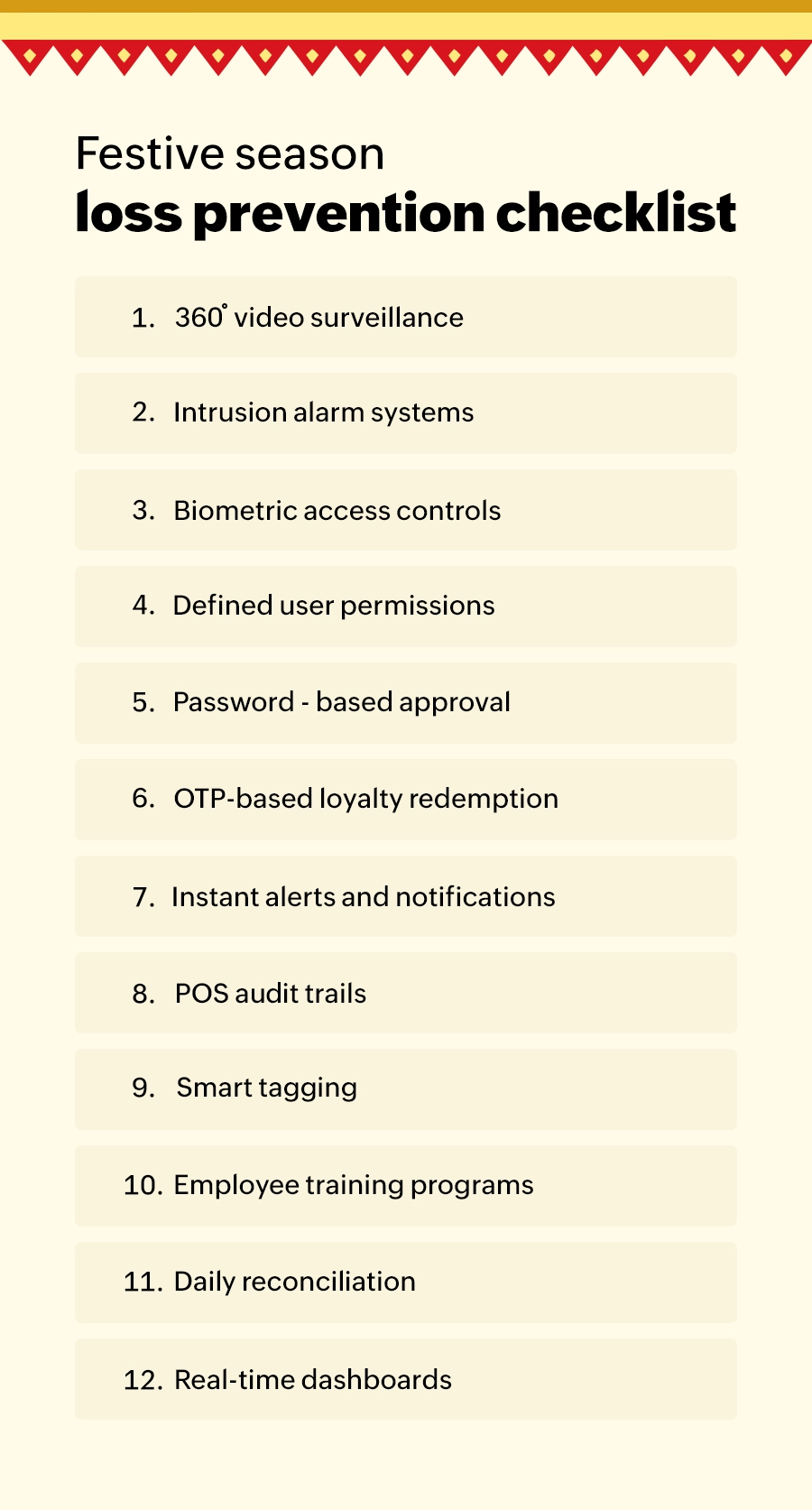

Your festive season loss prevention checklist

- Video surveillance covering billing counters, storage rooms, and exits.

- Intrusion alarm systems for restricted areas and after-hours protection.

- Keycard or biometric access controls to limit sensitive zone entry.

- Defined user permissions to restrict access to discounts and cancellations.

- Password or manager approval required for bill edits, deletions, and refunds.

- OTP-based loyalty redemption to prevent misuse of reward points.

- Instant alerts and notifications for malpractice or unusual POS activity.

- POS audit trails to track every edit, delete, and issue discounts with user details.

- Loss prevention tools like RFID tags and EAS gates for high-value items.

- Employee training programs on fraud detection and customer handling.

- Regular cash and inventory reconciliation to detect discrepancies early.

- Real-time dashboards for owners to monitor all outlets anytime, anywhere.

Conclusion

Increased footfall is great for sales; it’s also when your business is most vulnerable to theft and fraud. Finally, all business tends to get this profit boost, and as a cautious business owner, one should keep an eye on all of the above-mentioned threats and take proactive measures against them. The good news is most of the common and continuous thefts and frauds can be controlled if you are able to tick all of the above checkboxes in the checklist given.

This festive season, make every sale count, securely!